AI For Trading: Exercise:finding pairs (29)

Checking if a pair of stocks is cointegrated

Imports

import numpy as np

import pandas as pd

from sklearn.linear_model import LinearRegression

from statsmodels.tsa.stattools import adfuller

import matplotlib.pyplot as plt

import quiz_tests/opt/conda/lib/python3.6/site-packages/statsmodels/compat/pandas.py:56: FutureWarning: The pandas.core.datetools module is deprecated and will be removed in a future version. Please use the pandas.tseries module instead.

from pandas.core import datetools# Set plotting options

%matplotlib inline

plt.rc('figure', figsize=(16, 9))# just set the seed for the random number generator

np.random.seed(2018)

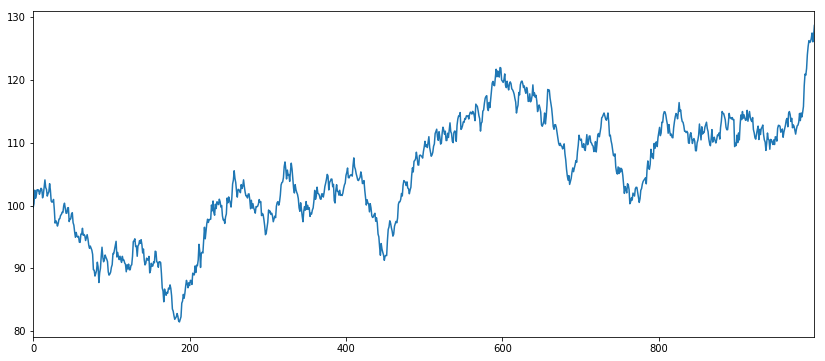

# use returns to create a price series

drift = 100

# 高斯分布的概率密度函数(获取1000个数据)

r1 = np.random.normal(0, 1, 1000)

# print(r1)

# print(np.cumsum(r1))

s1 = pd.Series(np.cumsum(r1), name='s1') + drift

s1.plot(figsize=(14,6))

plt.show()

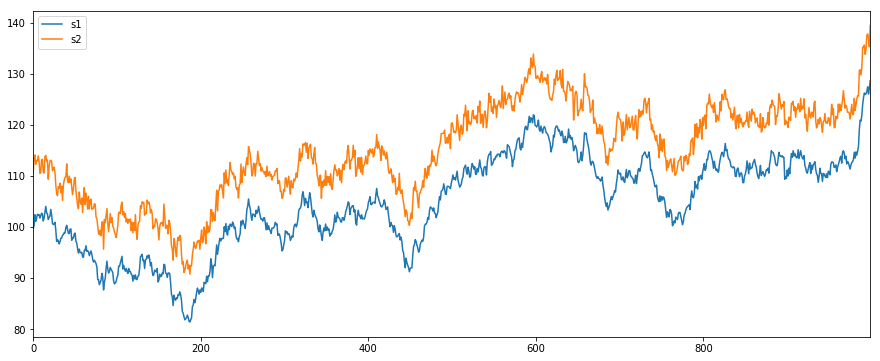

offset = 10

noise = np.random.normal(0, 1, 1000)

s2 = s1 + offset + noise

s2.name = 's2'

pd.concat([s1, s2], axis=1).plot(figsize=(15,6))

plt.show()

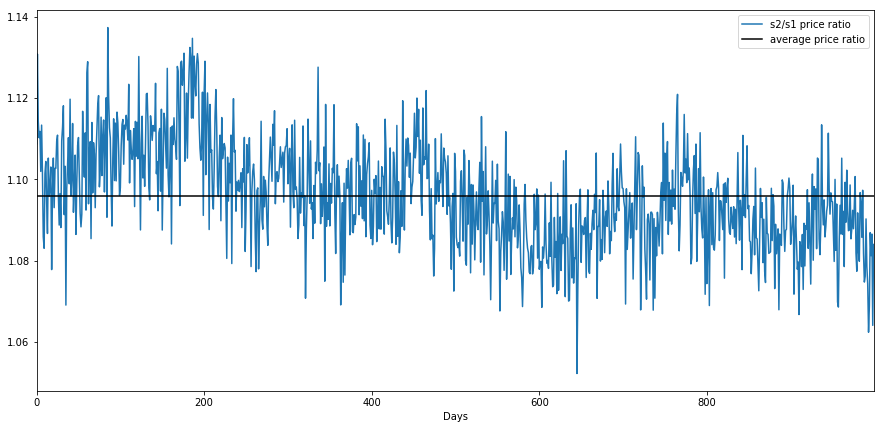

price_ratio = s2/s1

price_ratio.plot(figsize=(15,7))

plt.axhline(price_ratio.mean(), color='black')

plt.xlabel('Days')

plt.legend(['s2/s1 price ratio', 'average price ratio'])

plt.show()

print(f"average price ratio {price_ratio.mean():.4f}")

average price ratio 1.0960Calculate hedge ratio with regression

Linear Regression

Note that the LinearRegression().fit() expects 2D numpy arrays. Since s1 and s2 are pandas series, we can use Series.values to get the values as a numpy array. Since these are 1D arrays, we can use numpy.reshape(-1,1) to make these 1000 row by 1 column 2 dimensional arrays

type(s1)pandas.core.series.Seriestype(s1.values)numpy.ndarrays1.values.reshape(-1,1).shape(1000, 1)lr = LinearRegression()

lr.fit(s1.values.reshape(-1,1),s2.values.reshape(-1,1))LinearRegression(copy_X=True, fit_intercept=True, n_jobs=1, normalize=False)hedge_ratio = lr.coef_[0][0]

hedge_ratio1.002234357791276intercept = lr.intercept_[0]

intercept9.753022747192901print(f"hedge ratio from regression is {hedge_ratio:.4f}, intercept is {intercept:.4f}")hedge ratio from regression is 1.0022, intercept is 9.7530Question

Do you think we'll need the intercept when calculating the spread? Why or why not?

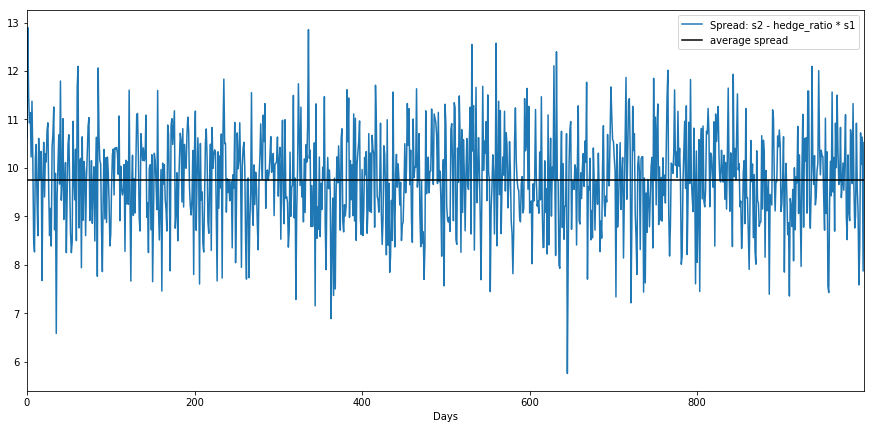

Calculate the spread

spread = s2 - s1 * hedge_ratioprint(f"Average spread is {spread.mean()}")Average spread is 9.753022747192906spread.plot(figsize=(15,7))

plt.axhline(spread.mean(), color='black')

plt.xlabel('Days')

plt.legend(['Spread: s2 - hedge_ratio * s1', 'average spread'])

plt.show()

Let's see what we get if we include the intercept of the regression

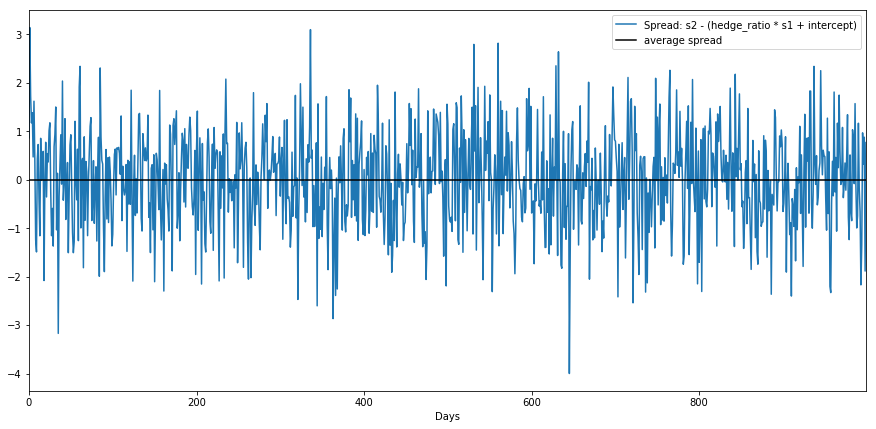

spread_with_intercept = s2 - (s1 * hedge_ratio + intercept)

print(f"Average spread with intercept included is {spread_with_intercept.mean()}")Average spread with intercept included is 6.210143510543276e-15spread_with_intercept.plot(figsize=(15,7))

plt.axhline(spread_with_intercept.mean(), color='black')

plt.xlabel('Days')

plt.legend(['Spread: s2 - (hedge_ratio * s1 + intercept)', 'average spread'])

plt.show()

Quiz

Check if spread is stationary using Augmented Dickey Fuller Test

The adfuller function is part of the statsmodel library.

adfuller(x, maxlag=None, regression='c', autolag='AIC', store=False, regresults=False)[source]

adf (float) – Test statistic

pvalue (float) – p-value

...def is_spread_stationary(spread, p_level=0.05):

"""

spread: obtained from linear combination of two series with a hedge ratio

p_level: level of significance required to reject null hypothesis of non-stationarity

returns:

True if spread can be considered stationary

False otherwise

"""

#TODO: use the adfuller function to check the spread

adf_result = adfuller(spread)

#get the p-value

pvalue = adf_result[1]

print(f"pvalue {pvalue:.4f}")

if pvalue <= p_level:

print(f"pvalue is <= {p_level}, assume spread is stationary")

return True

else:

print(f"pvalue is > {p_level}, assume spread is not stationary")

return False

quiz_tests.test_is_spread_stationary(is_spread_stationary)pvalue 0.0000

pvalue is <= 0.05, assume spread is stationary

Tests Passed# Try out your function

print(f"Are the two series candidates for pairs trading? {is_spread_stationary(spread)}")pvalue 0.0000

pvalue is <= 0.05, assume spread is stationary

Are the two series candidates for pairs trading? True为者常成,行者常至

自由转载-非商用-非衍生-保持署名(创意共享3.0许可证)