AI For Trading:Smoothing (66)

Smoothing

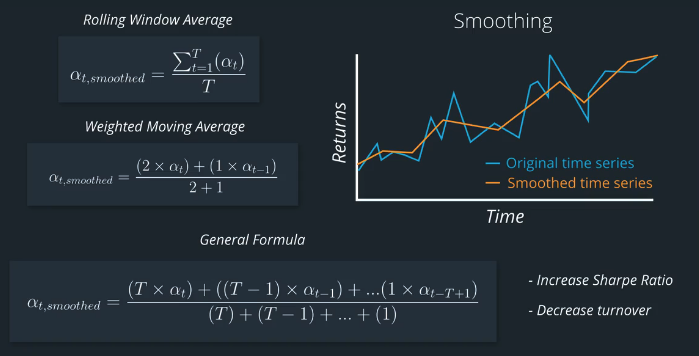

Financial data is noisy, and sometimes the data we're working with is sparse. For instance, it might have many missing values. We can apply smoothing techniques across the time dimension to help make the factor more robust to noise and sparse data.

Quize

Check out the documentation for two smoothing functions: simplemovingaverage and exponentialWeightedMovingAverage

练习题

How would you set the arguments of the ExponentialWeightedMovingAverage so that it gave the same result as SimpleMovingAverage?

A:decay=SimpleMovingAverage

B: decay=0

C: decay=1

D: decay = NaN

答案:C

Smoothing

Install packages

import sys!{sys.executable} -m pip install -r requirements.txtimport cvxpy as cvx

import numpy as np

import pandas as pd

import time

import os

import quiz_helper

import matplotlib.pyplot as plt%matplotlib inline

plt.style.use('ggplot')

plt.rcParams['figure.figsize'] = (14, 8)data bundle

import os

import quiz_helper

from zipline.data import bundlesos.environ['ZIPLINE_ROOT'] = os.path.join(os.getcwd(), '..', '..','data','module_4_quizzes_eod')

ingest_func = bundles.csvdir.csvdir_equities(['daily'], quiz_helper.EOD_BUNDLE_NAME)

bundles.register(quiz_helper.EOD_BUNDLE_NAME, ingest_func)

print('Data Registered')Build pipeline engine

from zipline.pipeline import Pipeline

from zipline.pipeline.factors import AverageDollarVolume

from zipline.utils.calendars import get_calendar

universe = AverageDollarVolume(window_length=120).top(500)

trading_calendar = get_calendar('NYSE')

bundle_data = bundles.load(quiz_helper.EOD_BUNDLE_NAME)

engine = quiz_helper.build_pipeline_engine(bundle_data, trading_calendar)View Data露

With the pipeline engine built, let's get the stocks at the end of the period in the universe we're using. We'll use these tickers to generate the returns data for the our risk model.

universe_end_date = pd.Timestamp('2016-01-05', tz='UTC')

universe_tickers = engine\

.run_pipeline(

Pipeline(screen=universe),

universe_end_date,

universe_end_date)\

.index.get_level_values(1)\

.values.tolist()

universe_tickersGet Returns data

from zipline.data.data_portal import DataPortal

data_portal = DataPortal(

bundle_data.asset_finder,

trading_calendar=trading_calendar,

first_trading_day=bundle_data.equity_daily_bar_reader.first_trading_day,

equity_minute_reader=None,

equity_daily_reader=bundle_data.equity_daily_bar_reader,

adjustment_reader=bundle_data.adjustment_reader)Get pricing data helper function

def get_pricing(data_portal, trading_calendar, assets, start_date, end_date, field='close'):

end_dt = pd.Timestamp(end_date.strftime('%Y-%m-%d'), tz='UTC', offset='C')

start_dt = pd.Timestamp(start_date.strftime('%Y-%m-%d'), tz='UTC', offset='C')

end_loc = trading_calendar.closes.index.get_loc(end_dt)

start_loc = trading_calendar.closes.index.get_loc(start_dt)

return data_portal.get_history_window(

assets=assets,

end_dt=end_dt,

bar_count=end_loc - start_loc,

frequency='1d',

field=field,

data_frequency='daily')get pricing data into a dataframe

returns_df = \

get_pricing(

data_portal,

trading_calendar,

universe_tickers,

universe_end_date - pd.DateOffset(years=5),

universe_end_date)\

.pct_change()[1:].fillna(0) #convert prices into returns

returns_dfSector data helper function

We'll create an object for you, which defines a sector for each stock. The sectors are represented by integers. We inherit from the Classifier class. Documentation for Classifier, and the source code for Classifier

from zipline.pipeline.classifiers import Classifier

from zipline.utils.numpy_utils import int64_dtype

class Sector(Classifier):

dtype = int64_dtype

window_length = 0

inputs = ()

missing_value = -1

def __init__(self):

self.data = np.load('../../data/project_4_sector/data.npy')

def _compute(self, arrays, dates, assets, mask):

return np.where(

mask,

self.data[assets],

self.missing_value,

)sector = Sector()We'll use 2 years of data to calculate the factor

Note: Going back 2 years falls on a day when the market is closed. Pipeline package doesn't handle start or end dates that don't fall on days when the market is open. To fix this, we went back 2 extra days to fall on the next day when the market is open.

factor_start_date = universe_end_date - pd.DateOffset(years=2, days=2)

factor_start_dateExplore the SimpleMovingAverage Function

The documentation for SimpleMovingAverage is located here, and is also pasted below:

class zipline.pipeline.factors.SimpleMovingAverage(*args, **kwargs)[source]

Average Value of an arbitrary column

Default Inputs: None

Default Window Length: NoneNotice that the description doesn't show us the syntax for the parameters for Inputs and Window Length. Looking at the source code, we can see that SimpleMovingAverage is a class that inherits from CustomFactor.

Here's the documentation for CustomFactor. Notice that it includes parameters inputs and window_length.

Quiz 1

Create a factor of one year returns, demeaned, and ranked, and then converted to a zscore.

Put this factor as the input into a SimpleMovingAverage function, with a window length for 1 week (5 trading days). Also rank and zscore this smoothed factor. Note that you don't need to make it sector neutral, since the original factor is already demeaned by sector.

Answer 1

#TODO: import Returns from zipline

from zipline.pipeline.factors import Returns

# TODO: import SimpleMovingAverage from zipline

from zipline.pipeline.factors import SimpleMovingAverage

#TODO

# create a pipeline called p

p = Pipeline(screen=universe)

# create a factor of one year returns, deman by sector, then rank

factor = (

Returns(window_length=252, mask=universe).

demean(groupby=Sector()). #we use the custom Sector class that we reviewed earlier

rank().

zscore()

)

# TODO

# Use this factor as input into SimpleMovingAverage, with a window length of 5

# Also rank and zscore (don't need to de-mean by sector, s)

factor_smoothed = (

SimpleMovingAverage(inputs=[factor], window_length=5).

rank().

zscore()

)

# add the unsmoothed factor to the pipeline

p.add(factor, 'Momentum_Factor')

# add the smoothed factor to the pipeline too

p.add(factor_smoothed, 'Smoothed_Momentum_Factor')visualize the pipeline

Note that if the image is difficult to read in the notebook, right-click and view the image in a separate tab.

p.show_graph(format='png')run pipeline and view the factor data

df = engine.run_pipeline(p, factor_start_date, universe_end_date)df.head()Let's grab some data for one stock

# these are the index values for all the stocks (index level 1)

df.index.get_level_values(1)[0:5]Quiz 2

Get the index value for APPL stock

Answer 2

# TODO

# get the level value for AAPL (it's at row index 3)

stock_index_name = df.index.get_level_values(1)[3]

print(type(stock_index_name))

print(stock_index_name)Stack overflow example of how to use numpy.in1d

#notice, we'll put the stock_index_name inside of a list

single_stock_df = df[np.in1d(df.index.get_level_values(1), [stock_index_name])]

single_stock_df.head()single_stock_df['Momentum_Factor'].plot()

single_stock_df['Smoothed_Momentum_Factor'].plot(style='--')Quiz 3

How would you describe the smoothed factor values compared to unsmoothed factor values?

Answer 3

The smoothed factor values follow the original factor values but are a bit less volatile (they're smoother)!

为者常成,行者常至

自由转载-非商用-非衍生-保持署名(创意共享3.0许可证)